Transport Topics | A Private Fleet Resurgence

In the August 2019 edition of Transport Topics Fleet 100, CPC Vice-President Jeffrey Hart outlines the emerging trend of companies insourcing private fleets. CDL Driver sourcing is a big component of the value equation for many private fleets, due to the fact that it enhances fleet consistency, control, safety and overall performance. Private fleet resurgence is a trend that will help companies of all sizes as the trucking market evolves in the coming years. Click here or the image below to read this insightful analysis.

FULL TEXT OF ARTICLE AS ORIGINALLY PUBLISHED BY TRANSPORT TOPICS BELOW

Nearly everything we touch during the day has been on a truck at one time or another. Companies have raw materials brought in for production or assembly, and finished goods delivered out for sale. Though this cycle never changes, our trucking industry is experiencing a sea change regarding HOW these companies are moving these products. Private fleets are well-known for their superior, nimble service, but did you know that these fleets may also be your cheaper option these days?

Shippers typically select from three primary modes of transportation: outside trucking companies (“common carriers”), 3rd party logistics or “dedicated” fleet providers, and “private fleets” to haul their freight. Historically, companies requiring superior service with specialized, unique or complex internal and external delivery requirements have often chosen to operate private fleets, with more than 200,000 companies operating private fleets in America. These firms “control their own destiny” and know that their goods and raw materials will be moved when and where needed because they have their own (owned or leased) trucks and drivers. Private fleets are most efficiently operated when companies have freight that is routinely shipped to and from the same facilities (or others nearby) to facilitate backhauls, which positively impact value of operating a private fleet.

Though private fleets typically offer more freedom to select technology/equipment for sustainability and optimization, offer less volatility for budgeting and forecasting, and provide more control over freight decisions, these other modes of transportation have advantages, as well. If a company does not have unique service requirements, doesn’t have “static” return trip freight hauling opportunities for backhaul efficiencies, or doesn’t want this responsibility or expertise required to operate a private fleet, they turn to these common carriers and 3rd parties to haul their freight.

During this past year, we’ve seen a significant expansion of this private fleet model from companies that have traditionally hauled through 3rd party carriers. WHY? Our fast-growing driver shortage has contributed to this new trend, but lower cost is another primary reason for this shift to private fleets. If optimized to fully utilize these trucks and drivers, private fleets often compare favorably when factoring in all costs associated with operating a fleet or using outside carriers. Many CDL drivers have a strong preference to drive for private fleets, and recent technology advancements (dynamic routing, freight matching software, KPI analytics) and partnership development opportunities (e.g. for backhaul securement) help create efficiencies a well-run fleet will produce.

In today’s trucking landscape, with truck and driver capacity challenges, changing regulations, and expansion of e-commerce related just-in-time and last mile delivery requirements, THOSE WHO CONTROL THE TRUCKS AND DRIVERS WIN. Private fleets are usually not the right solution for 100% of a company’s transportation needs, but they average roughly 68% of a company’s outbound freight shipments according to the most recent national survey (National Private Truck Council, www.nptc.org, a good resource for private fleet benchmarking statistics, fleet start-up support information). Right-sizing makes the private fleet the best solution within an optimal mix of in-house trucks and outside carriers.

These private fleet operators don’t have to pay $5/mile spot rates or extra charges needed to get their freight moved; they have the same driver in the same truck every day with a fraction of turnover associated with 3PL’s and carriers; and, they typically have excellent safety and compliance records. Management can sleep at night knowing they won’t have production shutdowns due to freight delays, and their goods will be timely delivered to their dealerships, stores and customers.

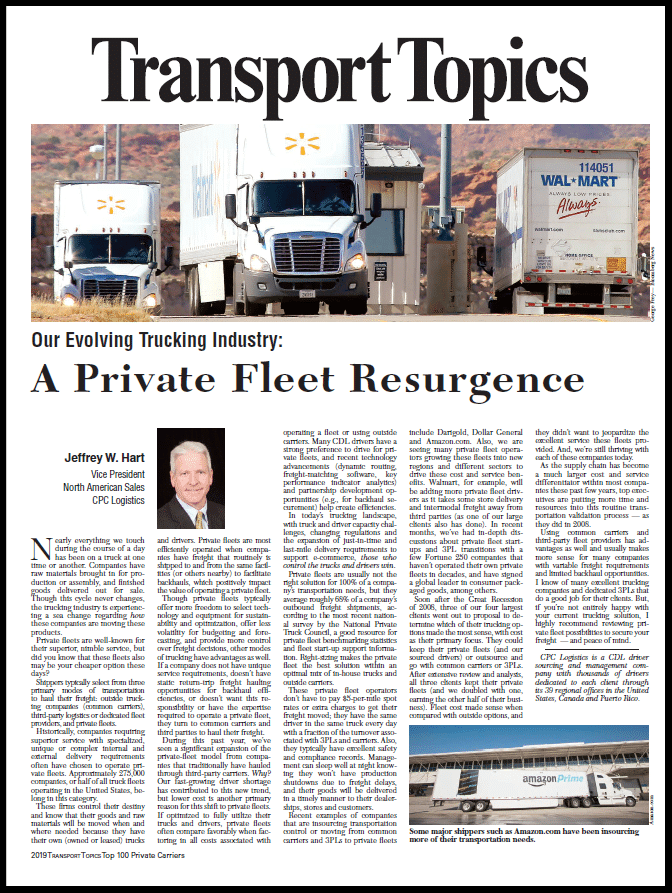

Recent examples of companies that are insourcing transportation control or moving from common carriers and 3PL’s to private fleets include Darigold, Dollar General, and Amazon. We’re also seeing many private fleet operators grow these fleets into new regions and different sectors to drive these cost and service benefits. Wal-Mart, for example, will be adding 1,000 more private fleet drivers as they take store delivery and drayage (port) freight away from 3rd parties (as one of our large clients has also done). During these past few months alone, we’ve had in-depth private fleet start-up/3PL transition discussions with a few Fortune 250 companies that haven’t operated their own private fleets in decades!

Soon after the Great Recession of 2008, 3 of our 4 largest clients “went out to proposal” to determine of their trucking options made the most sense, with cost as their primary focus. They could keep their private fleets (and our sourced drivers) or outsource and go with common carriers/3PL’s. After extensive review and analysis, all 3 clients kept their private fleets (and we doubled with one, earning the other half of their business) – fleet cost made sense when compared to outside options and they didn’t want to jeopardize excellent service these fleets provided. And, we’re still thriving with each of these companies today. As the supply chain has become a much larger cost and service differentiator within most companies these past few years, top executives are putting much more time and resources into this routine transportation validation process – as they did back in 2008.

Using common carriers and 3rd party fleet providers have advantages, as well, and usually makes more sense for many companies with variable freight requirements and limited backhaul opportunities. I know of many excellent trucking companies and dedicated 3PL’s that do a good job for their clients. But, if you’re not entirely happy with your current trucking solution, I highly recommend reviewing private fleet possibilities to secure your freight … and, peace of mind.

Jeffrey W. Hart

Vice President – NA Sales

CPC Logistics/Driver Sourcing

800-558-8982

j.hart@cpclogistics.com

About CPC Logistics

CPC Logistics is North America’s largest CDL driver sourcing & management company with thousands of drivers dedicated to each client through its 39 regional offices in the U.S., Canada and Puerto Rico.